Intel in Crisis: Stock Value Drops 10% After Terrible Results

Keypoints:

- Intel reports 32% year-over-year decline in revenue and a net loss of $664 million for Q4 2022.

- Stock falls as much as 10% after the announcement.

- Slow PC market and surplus of chips cited as major factors in the company's struggles.

I ntel, once a tech giant, struggles with historic collapse in Q4 2022 results.

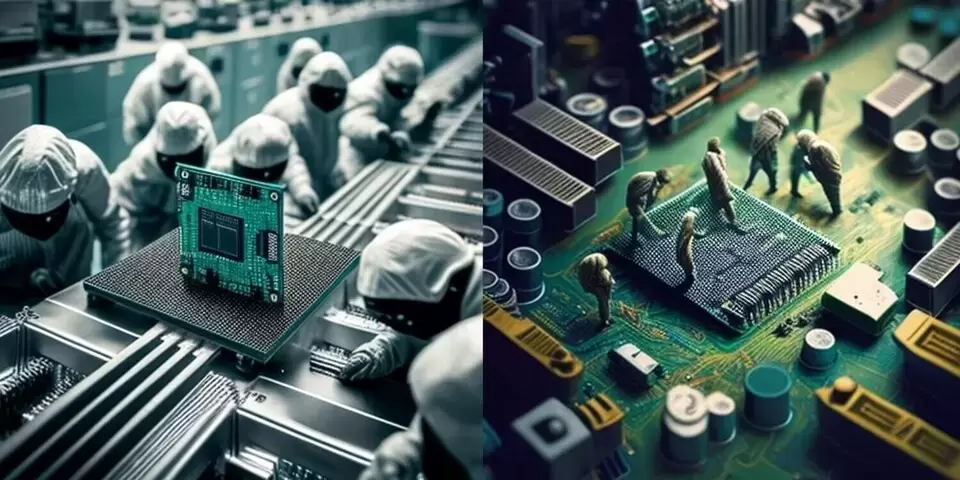

Intel, one of the biggest names in the technology industry, has reported a historic collapse in their quarterly and full-year results for 2022.

The company has seen a staggering 32% year-over-year decline in revenue, coupled with a net loss of $664 million for the fourth quarter.

The Surprise of the Investors

These disappointing numbers took both analysts and investors by surprise, leading to a sharp drop in Intel's stock value, with shares falling as much as 10% after the announcement. The chipmaker's troubles are not likely to abate anytime soon, with the company guiding to an adjusted net loss of 15 cents per share for the upcoming quarter.

Many experts attribute Intel's decline to a surfeit of chips and weakening demand for personal computers. The slowing PC market has put pressure on Intel's margins, forcing retailers to "correct" their inventories. This has led to a decline in consumer demand for PCs, which has had a significant impact on Intel's bottom line.

Some analysts said about the situation: "No words can portray or explain the historic collapse of Intel, with management attempting to blame a worst-ever PC inventory digestion dynamic and macro/China/enterprise to an over 20% q/q decline in sales."

The Responsabilites

The struggles at Intel have also put significant pressure on CEO Pat Gelsinger, who took the top job at the company in 2021. Gelsinger has acknowledged the difficulty of predicting when the current inventory and production issues will be resolved, but remains optimistic that the situation will improve.

The decline in Intel's stock value has been severe, with the company's stock down more than 42% from its 52-week high. This has led to several analysts cutting their price targets, and Rosenblatt has maintained its sell rating for the company, lowering its price target from $20 to $17.

It remains to be seen how Intel will recover from this historic collapse, but one thing is clear, the company is facing an uphill battle in the current market conditions.

With weakening demand for PCs and a surfeit of chips, Intel will need to find new ways to innovate and adapt in order to stay competitive in the technology industry.

Share Share Share