Vinco Ventures: Institutional Investors Increase Their Holdings

Keypoints:

- 16 institutional investors reported initiating new positions, while 14 reported liquidating their entire holdings.

- The institutional put/call ratio for BBIG is currently at 0.09, implying a bullish sentiment among options traders.

- Major shareholders of Vinco Ventures include BlackRock, Vanguard, State Street, Geode Capital Management, and BHP Capital.

V inco Ventures (BBIG) is attracting the attention of many institutional investors, who are disclosing their holdings in the stock through 13F filings

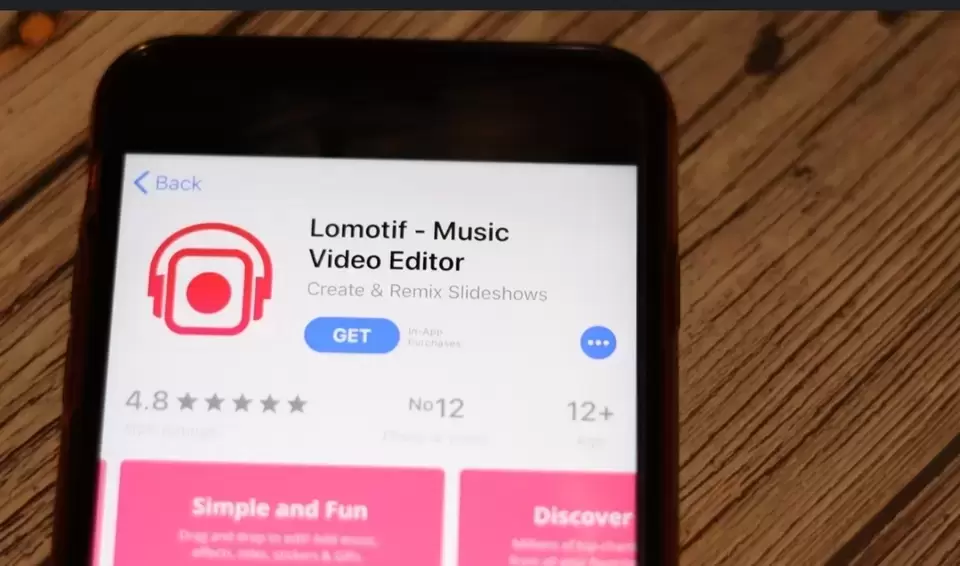

Shares of Vinco Ventures (NASDAQ: BBIG) are reflecting the positive sentiment among shareholders after the company's recent acquisition of Lomotif.

With BlackRock (BLK) being the largest shareholder of BBIG with a 13.97 million share stake, the investment giant's involvement could provide the necessary backing for a potential turnaround story in 2023.

Why is Going Really High

Vinco Ventures, a media and entertainment company, recently announced the acquisition of all the ZVV equity interest of ZVV Media Partners, which included the popular short video application Lomotif. The app has received over 225 million installations across 200 countries, making it a rival to ByteDance's TikTok. The company aims to make itself a major player in the media and entertainment space, and this acquisition is a step towards that goal.

In addition, shareholders are eagerly waiting for the company to file its delinquent Form 10-Qs for the quarters ended June 30 and September 30, which is expected to be done by January 30th. The timely filing of these documents will provide a clearer picture of the company's financial status and performance, which could impact the stock's performance.

Vinco Ventures has been in the news lately, due to its impressive stock performance and notable changes in institutional ownership. The company's stock has attracted the attention of many institutional investors, who are now disclosing their holdings in the stock through 13F filings.

Largest Shareholders

During Q3 of the current fiscal year, 90 institutional investors reported ownership of BBIG, a significant increase from the prior quarter. 16 of these investors reported initiating new positions, while 14 reported liquidating their entire holdings. The institutional put/call ratio for BBIG is currently at 0.09, which is a decrease from the previous quarter's ratio of 0.19. This ratio is equivalent to 2.44 million puts and 26.12 million calls, implying a bullish sentiment among options traders.

One of the largest shareholders of Vinco Ventures is BlackRock Inc. (BLK), which holds 13.97 million shares of the company. During Q3, BlackRock purchased an additional 1.96 million shares of BBIG. Another major shareholder is Vanguard Group, which holds 9.05 million shares and purchased an additional 254,044 shares during the same quarter.

State Street Corporation (STT) holds 4.03 million shares, after purchasing 898,913 shares in Q3. Geode Capital Management holds 3.8 million shares, after purchasing 876,034 shares during the quarter. BHP Capital holds 2.51 million shares, which it acquired during the same period.

It is worth mentioning that Five Narrow Lane, which was formerly the largest shareholder of BBIG, recently reported selling a majority of its stake. As of December 31, the fund held only 1 million shares, compared to its holdings of 22.55 million shares in Q2.

It is worth mentioning that Five Narrow Lane, which was formerly the largest shareholder of BBIG, recently reported selling a majority of its stake. As of December 31, the fund held only 1 million shares, compared to its holdings of 22.55 million shares in Q2.

It is worth noting that the company is yet to receive any coverage or financial estimates from analysts, which is not surprising given that analysts often stay away from low-priced stocks.

Nevertheless, with the acquisition of Lomotif and the filing of delinquent Form 10-Qs, BBIG stock holders are optimistic that 2023 will be a better year compared to 2022.

Share Share Share

(0) Comments

More from @rodrigo for #TickerTracker

View MoreDiscover the Billion-Dollar Secrets: Inside David Rolfe's Q1 2023 Portfolio

almost 3 years ago

10 views