Is Digital World Acquisition Headed for Doom?

Keypoints:

- DWAC stock hits new 52-week low amid reports of potential delisting.

- The company missed payments on some dues, leading to the delisting notice.

- DWAC plans to file an appeal, pay the corresponding fee, and resolve the matter.

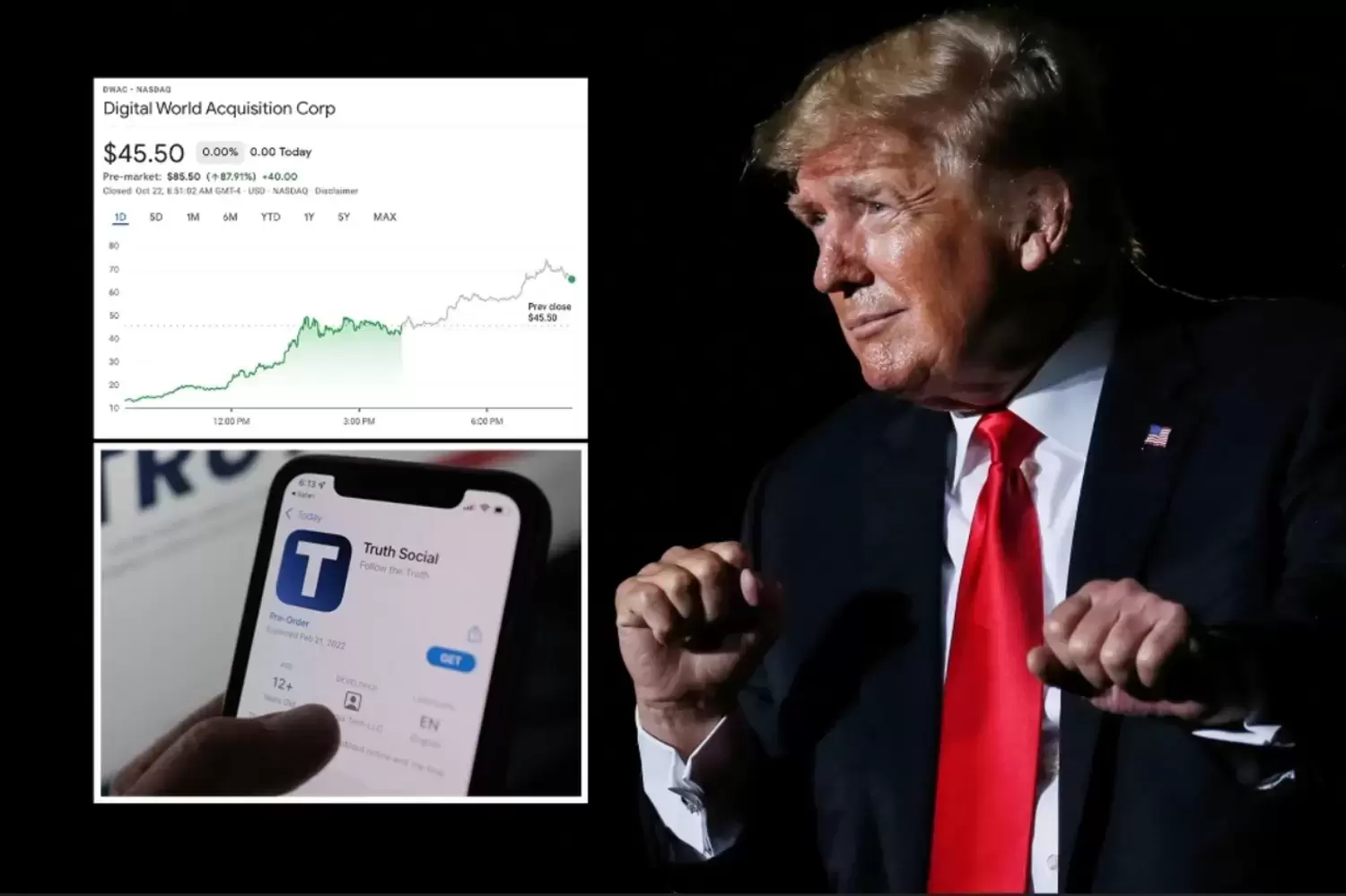

D igital World Acquisition (DWAC), is making headlines: the stock hitting a new 52-week low and reports of potential delisting, investors are on edge about the future of the company.

Digital World Acquisition (stock: DWAC has been in the spotlight recently as its stock hits a new 52-week low.

The reason for this is due to the company apparently failing to pay its dues to the exchange. However, it has since stated that it plans to pay the corresponding fee and any other fees the Hearing Department determines are due.

Shares of DWAC have been fallen, with a session low of 4.5% and hitting new 52-week lows when shares hit $14.10 shortly. Although the stock is down over 90% from its peak, it has only fallen less than 5% so far in 2023.

Reports of a potential delisting are at the center of the stock's decline, as DWAC missed its payments on some dues. Nevertheless, the company has elected to file an appeal of this matter and has stated that it plans to pay any fees the Hearing Department determines are due.

The Real Concern

Investors are concerned about DWAC's merger with Trump Media & Technology Group and the deal's slow pace in getting SEC approval. The company has pushed Congress to investigate the delay. DWAC extended the date to get the deal complete from March to June.

Trump Media & Technology Group, which is the company behind the Truth Social app (SPAC) has been attracting attention from investors who are curious about the potential implications of this merger.

As of now, former President Donald Trump has nearly 5 million followers on Truth Social, but this pales in comparison to his approximately 87.5 million followers on Twitter and 34 million on Facebook. However, his presence on social media platforms has been limited due to his involvement in the January 6th attack on the U.S. Capitol.

In fact, last month, the House of Representatives Jan. 6 committee voted unanimously to recommend that the Department of Justice investigate the former President on four referrals related to his role in inciting the attack. This has led to Trump being banned from several social media platforms, including Facebook and Twitter.

The Call

Recently, there have been reports that Trump is petitioning Meta Platforms Inc, which owns Facebook, to unblock his account. His campaign has written a letter to Meta, arguing that the ban on his account has distorted and inhibited public discourse.

The situation with Trump and social media platforms has caused some uncertainty around Digital World Acquisition and its planned merger. However, despite this, DWAC shares are still being traded and attracting attention from investors.

It remains to be seen how this situation will play out, but it's clear that there is a lot of interest and potential for Digital World Acquisition and its merger with Trump Media & Technology Group. Investors will likely be watching closely to see how events unfold and how it may impact the value of DWAC shares in the coming weeks and months.

Share Share Share